Apr 26, 2018 | Uncategorized

The lack of homes for sale around Wisconsin is making home buying a challenge this spring. This is because we’re currently in a seller’s market, where there’s a shortage of properties in the face of rising demand, resulting in pricing power for the seller. In this environment, when a home lands on the market, it’s not uncommon for there to be a bidding war among the buyers before the home is sold for well above asking price, typically a few days or weeks later. This can make the home buying process challenging and, at times, discouraging. We’ve put together the top 5 tips to navigate a seller’s market to help you succeed in the competitive market this spring.

Get Pre-Approved

Getting pre-approved for a mortgage is not only a great first step for any buyer, but it shows the seller you’re a qualified and motivated buyer. The process is different from getting pre-qualified, as pre-approval requires running credit reports and other documentation to determine how much your lender is willing to lend you. Plus, you’ll know just how much house you can afford, putting you a step ahead of other buyers in the market.

[Related post: The 6 Steps to the Mortgage Approval Process]

Find a Good Real Estate Agent

Although working with a real estate agent isn’t required, we highly recommend it, especially if you’re a first-time home buyer. Qualified and experienced real estate agents will help you make the right offer and save you time and money. Finding the right agent is important, which may take some dedicated time and research. When searching, ask your friends and family for referrals, look at reviews online, or look for agents’ contact information attached to ‘sold’ signs in desired neighborhoods. During interviews with prospective agents, be sure to check his or her credentials and ask to see a list of homes they’ve recently sold.

Be Quick and Flexible

In a seller’s market, a home that’s listed today could easily be gone tomorrow. This means that buyers need to be proactive when looking for homes, and not wait until the weekend to visit open houses and showings. This also means you shouldn’t fall in love with a home because you could easily be outbid by another buyer. When you’re ready to move forward, consider making an offer on the spot with your agent, as this will help speed up the process and beat other buyers to the punch.

A competitive market is also not an environment to negotiate on repairs, or request favors such asking to keep major appliances like the washer, dryer, and fridge. To prepare for some of the extra costs you can expect to incur when purchasing a new home, consider setting up a dedicated savings account or an adult piggy bank system while you’re beginning to look for a home. By the time you close, you’ll likely be well on your way to financing those furnishings and appliances.

[Related post: Sofas, Curtains, Refrigerators, Oh My! Your New Home’s Extra Expenses]

Find Out What the Seller Wants

Finding out the seller’s priorities, either by asking the seller directly or through your agent, can give you a big advantage over other buyers. It can be easy to assume that a seller’s biggest priority is to make top dollar, but not all sellers are the same. A seller could be relocating to a new city, in which case selling their home quickly might be their top priority. If you can show that you’re willing to accommodate those priorities, it can make you more competitive and a more attractive buyer to the seller.

Make Your Best Offer

In a competitive environment, you may only get one chance to make an offer on a home, so be sure to lead with your highest and best offer. Work with your real estate agent to determine an offer strategy, one that you believe is both fair and competitive. If there are multiple offers on a house, consider including an escalation clause, as it will increase your offer price by pre-set increments up to a predetermined maximum in order to beat out the competing offers.

Now that you’ve got these tips under your belt, are you ready to take on the competitive market? Give us a call, or apply online to get started!

Mar 7, 2018 | Uncategorized

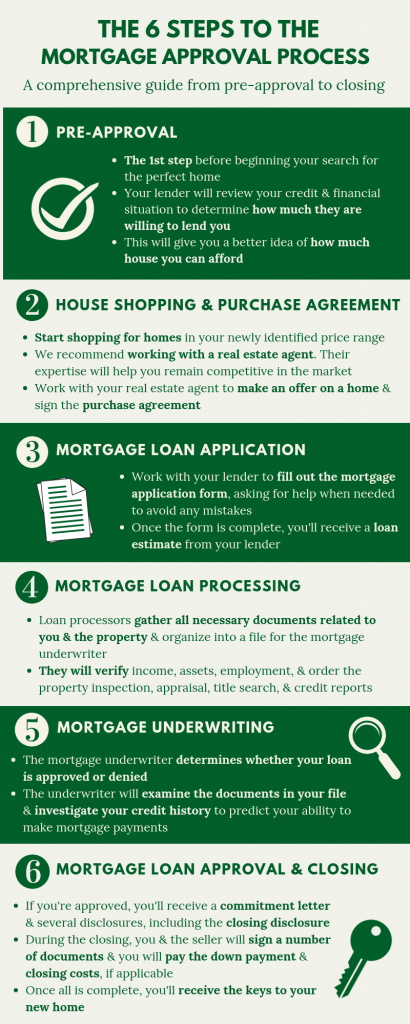

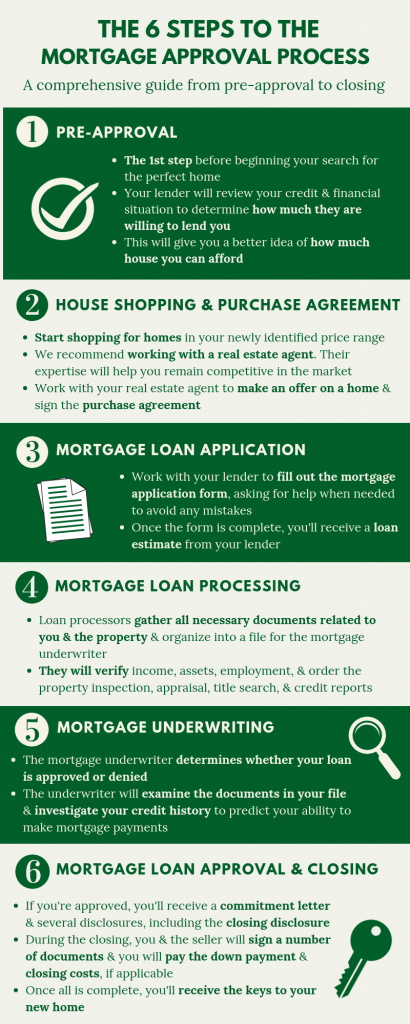

The prime home-buying season is just around the corner. To ensure you remain competitive in the housing market this year, it’s important to prepare yourself and understand the mortgage approval process ahead of time. Obtaining a home loan, especially if you’re a first-time home buyer, can be a confusing and overwhelming process. To make the process easier to understand, we’ve covered the 6 steps to the mortgage approval process from pre-approval to closing.

The prime home-buying season is just around the corner. To ensure you remain competitive in the housing market this year, it’s important to prepare yourself and understand the mortgage approval process ahead of time. Obtaining a home loan, especially if you’re a first-time home buyer, can be a confusing and overwhelming process. To make the process easier to understand, we’ve covered the 6 steps to the mortgage approval process from pre-approval to closing.

#1 Pre-Approval

Before shopping around for homes, we highly recommend getting pre-approved by a mortgage lender. During the pre-approval process, your lender will review your credit and financial situation to determine how much they are willing to lend you. This will give you a better idea of how much house you can afford so you can confidently shop in your price range. If you meet the minimum criteria, you will receive a pre-approval letter to use during your home search to show real estate agents and sellers that you are a serious buyer. Becoming pre-approved does not guarantee that you will be approved for a loan later in the process, but it is a great first step for all home buyers seeking financing.

#2 House Shopping & Purchase Agreement

Once you’re equipped with your pre-approval, your next step is to begin searching for homes within your newly identified price range. There are several resources available to find homes online, such as Zillow, Trulia, and your local Multiple Listing Service. However, we recommend first-time home buyers work with a real estate agent, as they will have a better understanding of the current market.

Once you find a home, your real estate agent will help you make an offer, and once the terms are approved by both parties, the purchase agreement is signed.

#3 Mortgage Loan Application

This step begins your journey to becoming approved for a loan to finance your new home. You will work with your mortgage lender to fill out the mortgage loan application, officially known as the Uniform Residential Loan Application (URLA), or Fannie Mae form 1003. The application contains several sections that capture information about you, your finances, and details of your potential mortgage. Since this form can sometimes be confusing, we recommend working closely with your lender and asking for help to ensure you’re completing the application accurately.

Once you complete the application, you’ll receive a loan estimate, which provides you with an estimated interest rate, monthly payment, and total closing costs for the loan. At this point, you are neither approved nor denied for a home loan; you are simply shown the loan terms your lender expects to offer if you’re approved.

#4 Mortgage Loan Processing

During this step, a loan processor will gather all necessary documents relating to you and the property, review the information, and organize into a loan file for the underwriter. Loan processors play a critical role in the process, as they double-check and fix any errors that may have been made in previous steps to give you the best chance of being approved. Loan processors will also begin verifying income, assets, and employment, and order the property inspection, appraisal, title search, and credit reports.

#5 Mortgage Underwriting

This step is arguably the most important in the mortgage approval process because it ultimately determines whether your loan is approved or denied. Mortgage underwriting is a process used to assess risk and ensure a borrower meets all of the minimum requirements for a home loan. The underwriter examines the documents within your loan file and heavily investigates your credit history to predict your ability to make mortgage payments. In this stage, your loan may be approved, approved with conditions, or denied. A mortgage approval with conditions typically means that your loan is approved, but you’ll need to provide further documentation or verification.

Some helpful tips for a smooth underwriting process include not making any significant life changes such as quitting your job, applying for a new credit card, or making any large purchases such as buying a new vehicle. Underwriters want to know that you’ll be able to afford the mortgage and any recent significant changes in your financial status may make them wary.

#6 Mortgage Loan Approval and Closing

Once you have met the underwriting requirements and are approved, you will be sent a commitment letter, which typically includes the type of loan program, loan amount, the loan term, interest rate, and conditions for approval. You will also receive several disclosures; among these is the closing disclosure, which explains the details of your mortgage loan and the amount you will pay for the various fees and services associated with closing your mortgage loan.

During the closing, you will typically be joined by your co-borrower, if applicable, an escrow officer, the seller’s attorney and yours, the closing agent, and the real estate agents who have been involved in the process on both sides. You and the seller will sign a number of documents in order for funds to be disbursed. You will also need to pay for the down payment and closing costs if they are not rolled into the loan amount. Once all is complete, you will receive your keys, signaling the end of the mortgage approval process.

Are you ready to tackle the mortgage approval process? Give us a call or apply online today to get started!

Feb 8, 2018 | Uncategorized

As a renter, it can be tiresome putting your hard-earned money into your landlord’s pockets each month, but it beats paying thousands on a new home each month, right? At first glance, renting may seem to be the smartest and least expensive option compared to buying, but if you’re planning on staying in the same location for seven to eight years, buying a home may be the optimal choice because of the potentially larger long-term payoffs. Knowing when and if to buy a home can be a difficult decision and one that should take serious consideration. We’ve put together the top five reasons to buy versus rent to help you decide what is best for you.

#1 Tax Advantages & Outright Savings

Perhaps one of the greatest benefits of homeownership is the many tax advantages associated with it. One of the main tax benefits is that owners do not pay taxes on the imputed rental income from their own homes, so they don’t have to count the rental value of their homes as taxable income. In comparison, landlords are required to count rent as income and renters do not have the opportunity to deduct the rent they pay. Homeowners may also deduct mortgage interest, property tax payments, and the capital gain they realize from selling their home, up to a limit.

In addition to all these deductions, the Madison, WI, housing market is healthy with several homes currently available on the market for $200,000 or less. With interest rates for a 30-year mortgage hovering around 4 percent, the average monthly mortgage payment for such a home would be $1,200, which is comparable to a middle-of-the-road 2-bedroom apartment in the area. And if you’re looking for a condo, you might even be able to save on your monthly housing cost while still having more bedrooms or greater square-footage.

#2 The Home is YOURS

One of the great benefits of being a homeowner is having the opportunity to customize, remodel, and renovate as you wish. And the greatest part: you don’t have to ask your landlord’s permission. You are free to customize your home inside and out, including landscaping, kitchen remodeling, replacing carpet with wood, installing a chandelier in the main entrance, or simply painting walls. Also, any change you make to the house has the potential to add value to the home later in life.

As a renter, your customization options are fairly limited. Typically, you’re able to make temporary changes, such as replacing knobs and handles, adding shelving to cabinets, or changing light fixtures; however, these changes will likely need to be reversed once you move.

#3 Stable Budget with Fixed Rate Mortgages

If you choose to finance your home with a fixed-rate mortgage you will benefit from budget stability because the interest rate remains the same for the entire term of the loan. As a homeowner, you’ll have greater flexibility in deciding how much you pay each month by choosing a shorter or longer loan term whether it’s a 10, 15, 20, 25 or 30-year term. Plus, when the mortgage is paid off, the house is yours to keep.

As a renter, you don’t have the same flexibility and stability when making payments each month to your landlord. Unless you’re living in a rent-controlled apartment, landlords have the ability to raise rent year after year, increasing your risk for instability in an unknown future.

#4 A Home is an Investment

Buying a home during a cycle where home values are on the rise means you not only gain equity on your home when you make your mortgage payment every month, but your equity also rises with the value of your home. Later down the road, you’ll have the ability to take income or lump-sum withdrawals out of your equity to help pay for a number of things, such as buying a second home, starting a college fund, or saving for retirement. As a renter, you won’t see these gains because your landlord reaps the benefits of building equity.

#5 Pride of Ownership & Family Life

Owning a home has been engrained in the concept of the American Dream for decades. It is sometimes seen as a symbol of success and accomplishment for homeowners and can build social status. Homeowners also have the opportunity to settle in and create a community, and a home may provide a larger space to raise a family or become an asset to pass on to children in the future. Renters aren’t able to gain these benefits because their living situation is seen as temporary.

Are you thinking about making the switch from renting to buying? Contact us to learn more about the benefits of homeownership and how we can help you get into a new home this year.

Dec 18, 2017 | Uncategorized

You can already see yourself standing at the threshold of your dream home, gleaming with pride as you hold your sparkling new set of keys. You know you’re ready to sign the paperwork and hand your money over for those keys, but have you done all of the research to prepare for your big purchase? To ensure everything goes smoothly, be sure to follow these four ‘must-dos’ for first-time homebuyers.

[Still deciding whether or not to become a first-time homebuyer? Ask yourself these three questions first.]

#1 Research Your Mortgage Program

If you decide to finance your home with a mortgage, your first step is to research which mortgage program is right for you. Our list of mortgage programs makes this step simple. The details of each program are listed to help you determine which program is right for you. As a first-time homebuyer, a US Federal Housing Administration (FHA) loan may appeal to you as it can help accommodate borrowers with low credit scores, typically below 500. The loan also only requires a down payment of 3.5%, while other loan programs generally require a larger down payment.

#2 Calculate Your Total Monthly Housing Cost

Before purchasing your dream home, be sure to calculate all of the costs associated with buying and owning a home to make sure you remain within your budget. Along with your monthly mortgage payment, you will also need to account for homeowner’s insurance, tax payments, and homeowners association (HOA) fees, if applicable. To determine your monthly mortgage payment, use an online mortgage calculator. You’ll need to input your approximate loan amount, down payment, the term of the loan, and interest rate.

Standard homeowner’s insurance provides financial protection against loss due to disasters, theft, and accidents, and is required by most lenders if you choose to finance your home with a mortgage. Several factors help determine the rate of your homeowner’s insurance, but where you live plays one of the largest roles. States such as Florida and Louisiana have the highest rates, while Hawaii and Vermont have the lowest rates. Wisconsin’s average annual rate is on the lower end at $788, in comparison to the national average rate of $1,228.

Property taxes also vary by where you live and are generally based on your home’s value. To determine your property tax, a local tax assessor will establish the tax rate for where you live, and that amount will be multiplied by the value of your home. To learn more about your local tax rate, check with your local county assessor; Dane County’s tax rate is currently 1.8%, which is approximately $4,149 per year for a home worth the median value of $230,800. Also, be aware that rates and fees may change over time, which will also affect your taxes.

Last, if you decide to purchase a home in a planned development, such as a leased property or gated community, you will be obligated to join that community’s HOA. This means you will need to pay monthly or annual fees to help maintain the quality of life for the community residents and to protect property values. Fees can range from $200 to $400 a month depending on the neighborhood or community.

#3 Account for Furnishings and Other Living Costs

As a first-time homebuyer, you will likely need to purchase furnishings and decorations to fill your new home, which can become expensive. To avoid going over your budget, calculate these purchases as part of your final cost of buying a home. Keep in mind that most new homes don’t come with sod, fences, window coverings, or even common appliances like a washer and dryer. Since new homeowners spend an average of $1,250 on appliances alone, it’s easy to blow your budget if you’re not factoring in all the items that you might need to buy.

It’s also wise to calculate your monthly living costs including utilities, groceries, phone bills, nights out, fuel, insurance, etc. to know just how much you’re spending each month. To help calculate these expenses, try using this in-depth monthly expenses calculator.

#4 Have Your Home Inspected

Before purchasing your home, new or used, it’s a good idea to have the home inspected, as it’s an inexpensive way to determine the condition of the home. The home inspection can also be used as a contingency in your purchase offer, meaning that if there are significant issues found you are able to back out of the purchase penalty-free. Typically, home inspectors will examine the exterior and interior of the home and make a report of their findings. The average home inspection costs around $315, however, they can range from $200 to $400+ depending on the size of your home.

Are you ready to make your dream of owning your first home a reality? Contact one of our mortgage professionals to learn more about our loan programs today!

Nov 16, 2017 | Uncategorized

You’ve spent months searching for the perfect home, getting everything organized to prepare for the big purchase. But there’s a problem… it’s nearly winter and prime home-buying season is still months away. The anticipation of waiting till spring is driving you crazy, as you wonder, “Is it really unorthodox to buy a home in the winter?” In fact, it’s not. Contrary to what many people believe, winter is a great time to buy a home for many reasons.

Before you purchase a new home this winter, read up on the top five advantages to buying a home in the off-season.

#1 Less Competition

Since most people wait until spring to shop around for new homes, there will be fewer buyers in the market. This is advantageous to you in several ways, as the law of supply and demand works in your favor. Because supply is higher but demand is lower, it’s less likely there will be multiple offers on your dream home because competition won’t be as great. And since there are fewer buyers, you’ll have more flexibility with what you offer. Sellers are more likely to be motivated to sell at a lower price or make a deal with you because there’s less competition.

A helpful tip: Don’t be afraid to make an offer that’s below the asking price, especially if the home has been on the market for a while. Ask your real estate agent what the sellers’ circumstances are; they may need to sell the house as soon as possible and, therefore, may be more willing to sell at a lower price.

#2 You See How a House Handles Winter Conditions

This is where harsh winter weather will work in your favor. A great advantage to winter home-buying is having the opportunity to see how well the house handles the cold, moisture, and wind. When touring a home, make sure to check the plumbing, heating, roof, and gutters. Also, be aware of issues such as air leaks, ice dams, or leaky roofs. Since it may be more difficult to inspect a home because of ice or snow, ask the sellers when the roof was last replaced, or when the septic tank was last serviced. Make sure to ask for receipts to back up their claims in case you discover unexpected damages to the house after the closing process. Also, keep in mind that you can always negotiate with the seller to make repairs or to lower the selling price when major issues are found.

#3 More Focus on You

During the winter months, real estate agents and lenders, like Easy Mortgage, aren’t anywhere near as busy as they would be during the peak selling and buying seasons. This is advantageous because your realtor will have more time to focus on finding the right home for you, while your lender works to get money in your hands. The closing process, which can sometimes take up to a month, may also be quicker when purchasing a home in the winter because of the slower market.

#4 Tax Incentives

If you close on a new home on or before December 31, you can deduct interest and property tax portions of your mortgage payment, points on your loan, and interest costs from your taxes. As a new homeowner, you will likely be faced with a monthly mortgage payment; however, at the beginning of your mortgage, most of your payment is interest, so a large portion of your payment may be tax deductible. Property tax deductions are also a great benefit, especially for those who live in states with higher property tax, because you then have the ability to take a larger deduction on your taxes. End-of-year tax benefits are one of the biggest motivations behind buying a house in the winter and can be especially handy while you pay off your home loan.

#5 Available Movers

As you probably know, spring and summer are the busiest seasons for moving and rental equipment companies. Luckily, if you purchase your home in the winter, you’ll be more easily able to secure the services of a moving company or rental equipment on short notice, as they are likely to be less busy. Not sure what you’ll need to move your belongings? Check out these helpful tips on how to choose the right moving truck.

Are you ready to deck the halls of your new home this winter? Contact us to learn more about our loan programs today!

Oct 16, 2017 | Uncategorized

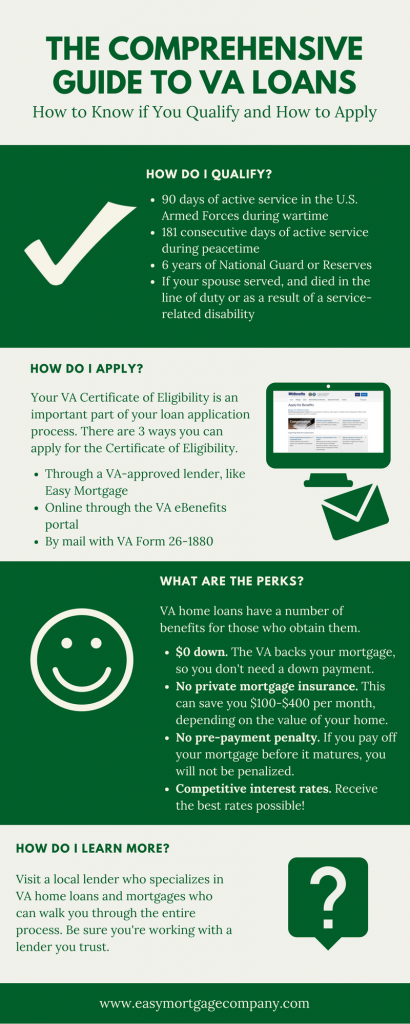

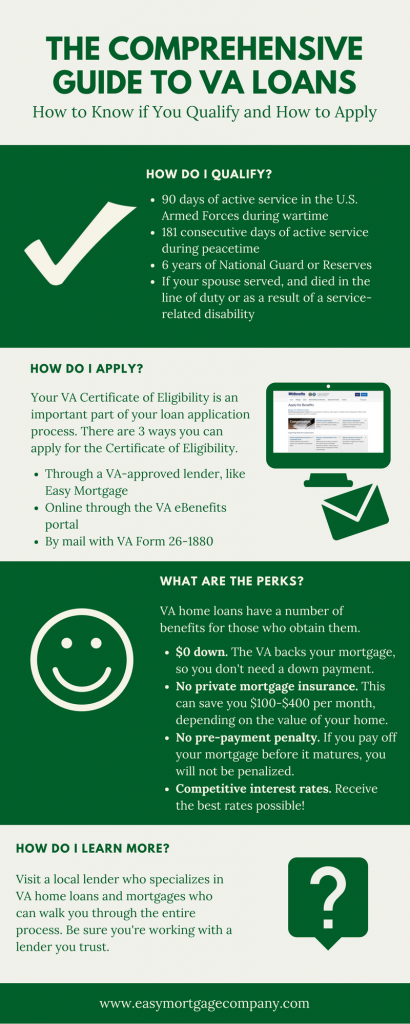

You’ve been shopping around for a new home, but aren’t sure of the steps to take to apply for a VA home loan. We’ve developed a simple step-by-step guide and infographic to help get you into a new home this year.

Follow these 6 steps when you apply for a VA home loan:

Step 1: Check If You’re Eligible

Our list of VA home loan eligibility requirements goes into good detail and may help to determine if you qualify. Here are some basics:

- U.S. Armed Forces: your eligibility largely depends on when and how you served the United States. Check out our list above for specific requirements regarding certain wartimes, peacetime, National Guard, and Selected Reserve.

- Spouse of a vet: You may be eligible if you are the spouse of a veteran who has died in action, died of service-related disabilities, or who was classified as MIA or a POW.

Our list reviews several other eligibility requirements, including if you’re not a veteran/spouse of a veteran, and income and credit requirements.

Step 2: Find A Lender You Can Trust

After determining your eligibility, your next step is to locate a lending institution that participates in the VA program, such as Easy Mortgage. Asking friends for recommendations is another good way to find a lender that you can trust.

Step 3: Obtain A Certificate Of Eligibility

The Certificate of Eligibility (COE) plays a large role in the application process, as it verifies to the lender that you meet all of the eligibility requirements. A COE can be obtained through your VA-approved lender, like Easy Mortgage, online through the VA eBenefits portal, or by mail with a VA Form 26-1880.

Step 4: Sign A Purchase Agreement

Work with your real estate agent to negotiate a purchase agreement for your new home. Be sure to include a “VA Option Clause” in the purchase and sales agreement. You may also want to allow for a way to “escape” the contract with no penalty in your agreement in case you aren’t able to get the loan.

Step 5: Apply For Your VA Home Loan

Work with your lender to complete the loan application. Once the application is complete, your lender will order a VA appraisal to begin processing your information. After that’s processed, your lender will decide whether or not to grant the loan.

Step 6: Closing The Deal

Once everything’s approved, your lender will then choose a title company, and a representative or attorney to coordinate the transfer of property.

Are you ready to own your dream home? Fill out our simple online application or contact one of our mortgage professionals to get started on your VA home loan application!

The prime home-buying season is just around the corner. To ensure you remain competitive in the housing market this year, it’s important to prepare yourself and understand the mortgage approval process ahead of time. Obtaining a home loan, especially if you’re a first-time home buyer, can be a confusing and overwhelming process. To make the process easier to understand, we’ve covered the 6 steps to the mortgage approval process from pre-approval to closing.

The prime home-buying season is just around the corner. To ensure you remain competitive in the housing market this year, it’s important to prepare yourself and understand the mortgage approval process ahead of time. Obtaining a home loan, especially if you’re a first-time home buyer, can be a confusing and overwhelming process. To make the process easier to understand, we’ve covered the 6 steps to the mortgage approval process from pre-approval to closing.